Introduction of Corporate tax in the UAE from 1 June 2023

Introduction

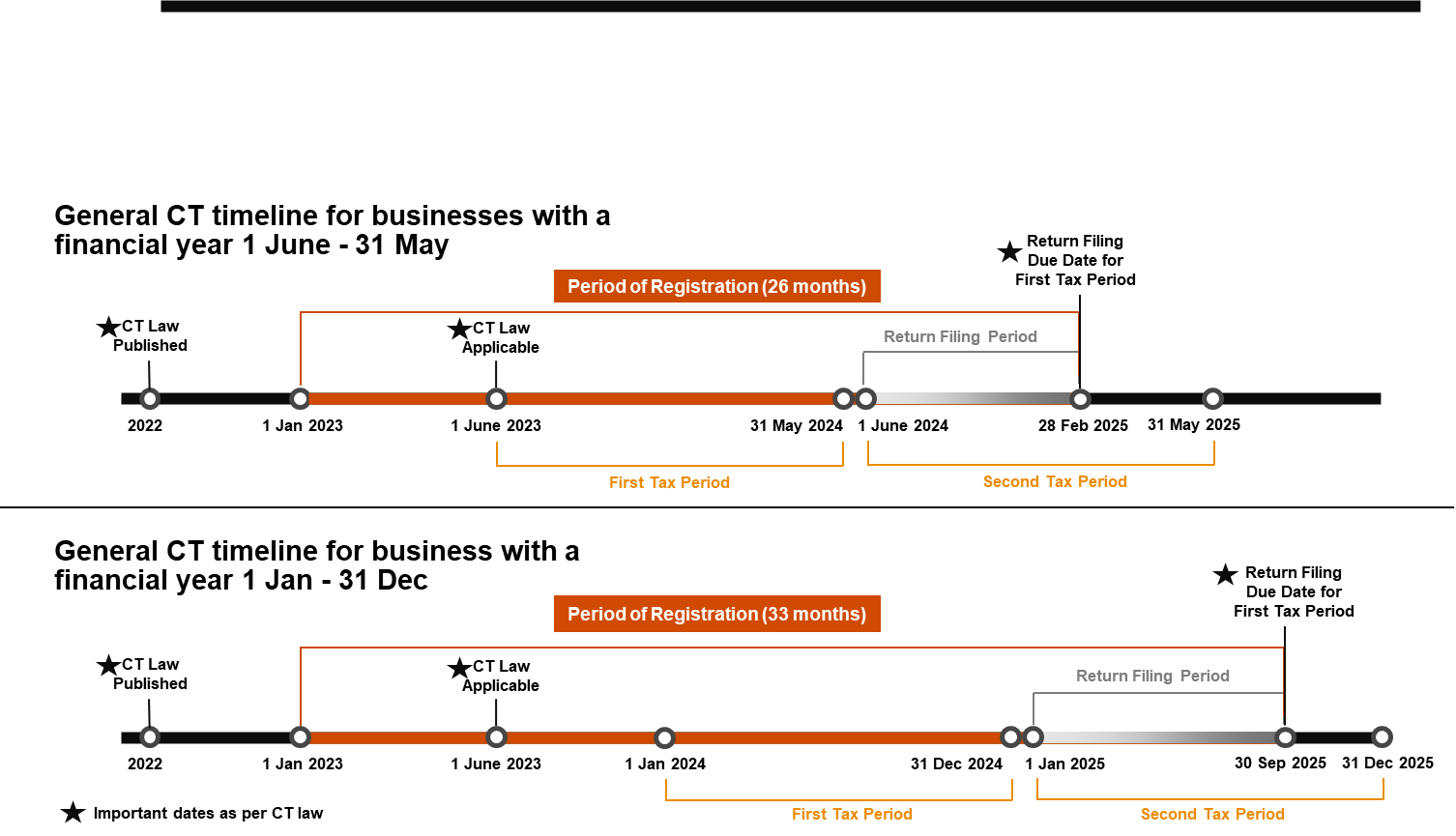

In accordance with the United Arab Emirates (UAE) Federal Decree-Law No. 47 of 2022 pertaining to the taxation of companies and enterprises, commonly referred to as the “Corporate Tax Law,” entities will be liable to pay UAE Corporate Tax commencing from the inception of their initial fiscal year that commences on or after the 1st of June 2023.

Corporate Tax represents a direct tax applied to the after-tax profits of corporations and various business entities.

Who is subject or exempted to Corporate Tax

Corporate Tax is applicable to the following categories of “Taxable Persons”:

- UAE-based companies and other legal entities that are either incorporated within the UAE or under the effective management and control of the UAE.

- Individuals (natural persons) who engage in business or business activities within the UAE, as defined in a forthcoming Cabinet Decision.

- Foreign legal entities (non-resident juridical persons) with a Permanent Establishment in the UAE.

Moreover, entities established within a UAE Free Zone also fall under the purview of Corporate Tax as “Taxable Persons” and must adhere to the stipulations outlined in the Corporate Tax Law. However, entities meeting the criteria to be designated as Qualifying Free Zone Persons can enjoy a Corporate Tax rate of 0% on their Qualifying Income.

For non-resident individuals lacking a Permanent Establishment in the UAE or earning income within the UAE unrelated to their Permanent Establishment, there may be a Withholding Tax applied, typically at a rate of 0%.

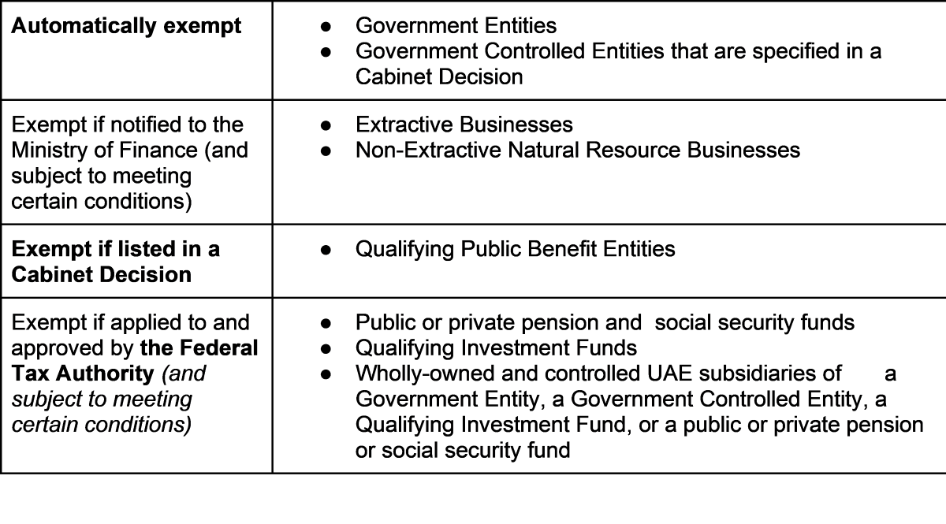

Certain specific categories of businesses or organizations, recognized for their significance and contributions to the UAE’s societal fabric and economy, are granted exemption from Corporate Tax. These entities are known as “Exempt Persons” and encompass:

Beyond being exempt from Corporate Tax, certain entities, including Government Entities, Government Controlled Entities as determined by a Cabinet Decision, Extractive Businesses, and Non-Extractive Natural Resource Businesses, may also find themselves relieved of registration, filing, and other compliance duties mandated by the Corporate Tax Law, unless they engage in activities that fall within the scope of Corporate Tax liability.

Definition of a Resident and Non-resident Person

Consistent with the taxation systems in many countries, the Corporate Tax Law adopts a dual approach, taxing income based on both residence and source criteria. The specific basis of taxation hinges on the classification of the entity subject to taxation.

- A “Resident Person” is liable for taxation on income originating from both domestic and international sources, adhering to a residence-based framework.

- Conversely, a “Non-Resident Person” is only subject to taxation on income arising from sources within the UAE, adhering to a source-based framework.

It’s crucial to note that determining residence for Corporate Tax purposes does not rely on an individual’s place of residence or domicile but instead hinges on distinct criteria delineated within the Corporate Tax Law. If an entity does not fulfill the conditions to be classified as either a Resident or Non-Resident person, they won’t be considered a Taxable Person and thus won’t be subject to Corporate Tax.

Entities such as companies and other legal entities incorporated or recognized under UAE laws are automatically designated as Resident Persons for Corporate Tax purposes. This encompasses legal entities formed in the UAE under mainland regulations, applicable Free Zone statutes, or those established through specific legislative decrees.

Foreign companies and legal entities may also assume the status of Resident Persons for Corporate Tax purposes if they are effectively managed and controlled within the UAE. This determination is contingent upon the entity’s specific circumstances and activities, with a key factor being the location where substantial management and commercial decisions are made.

Natural persons are subject to Corporate Tax as Resident Persons on income derived from both domestic and foreign sources, but solely in relation to income stemming from a Business or Business Activity conducted by the individual within the UAE. Other forms of income earned by natural persons fall outside the scope of Corporate Tax.

Non-Resident Persons are juridical entities that do not qualify as Resident Persons and fall into two categories:

- Those with a Permanent Establishment in the UAE.

- Those who receive income from UAE sources.

Non-Resident Persons are liable to pay Corporate Tax on Taxable Income attributable to their Permanent Establishment (explained in Section 8). Specific UAE-sourced income of Non-Resident Persons, not linked to a Permanent Establishment in the UAE, may be subject to a Withholding Tax rate of 0%.

Permanent Establishment

The concept of Permanent Establishment holds significant importance in international tax law and is a fundamental principle applied in corporate tax systems worldwide. In the context of the UAE Corporate Tax Law, the primary objective of the Permanent Establishment concept is to determine under what circumstances a foreign entity has established a substantial presence within the UAE, thus necessitating that the business profits of said foreign entity become subject to Corporate Tax.

The definition of Permanent Establishment as outlined in the Corporate Tax Law has been crafted based on the definition provided in Article 5 of the OECD Model Tax Convention on Income and Capital. Additionally, it aligns with the UAE’s stance as articulated in the Multilateral Instrument to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting. This alignment permits foreign entities to refer to the pertinent Commentary accompanying Article 5 of the OECD Model Tax Convention when assessing whether they have established a Permanent Establishment within the UAE. In making this assessment, due consideration should also be given to the provisions contained in any bilateral tax agreements between the home country of the Non-Resident Person and the UAE.

What Corporate Tax is imposed on

Corporate Tax is levied on the Taxable Income earned by a Taxable Person during a designated Tax Period. Typically, Corporate Tax is imposed on an annual basis, and the Taxable Person is responsible for computing their Corporate Tax liability through a self-assessment mechanism. In essence, this means that the calculation and settlement of Corporate Tax are carried out by the Taxable Person themselves, and they must file a Corporate Tax Return with the Federal Tax Authority.

To compute Taxable Income for the relevant Tax Period, the initial point of reference is the Taxable Person’s accounting income, which corresponds to their net profit or loss before tax, as indicated in their financial statements. Subsequently, certain adjustments must be made to arrive at the final Taxable Income. These adjustments encompass considerations such as income that is exempt from Corporate Tax and expenses that are either partially or entirely non-deductible for Corporate Tax purposes.

The Corporate Tax Law also specifies certain categories of income that are exempt from Corporate Tax. Consequently, Taxable Persons are not liable to pay Corporate Tax on such income, and they are ineligible to claim deductions for any associated expenses. However, it’s important to note that Taxable Persons who earn exempt income remain subject to Corporate Tax on their overall Taxable Income.

The primary objective behind exempting certain income from Corporate Tax is to prevent double taxation of specific types of income. In particular, dividends and capital gains stemming from both domestic and foreign shareholdings are generally granted exemptions from Corporate Tax. Furthermore, a Resident Person has the option, contingent upon meeting specific conditions, to exclude income derived from a foreign Permanent Establishment for the purposes of UAE Corporate Tax.

Deductions

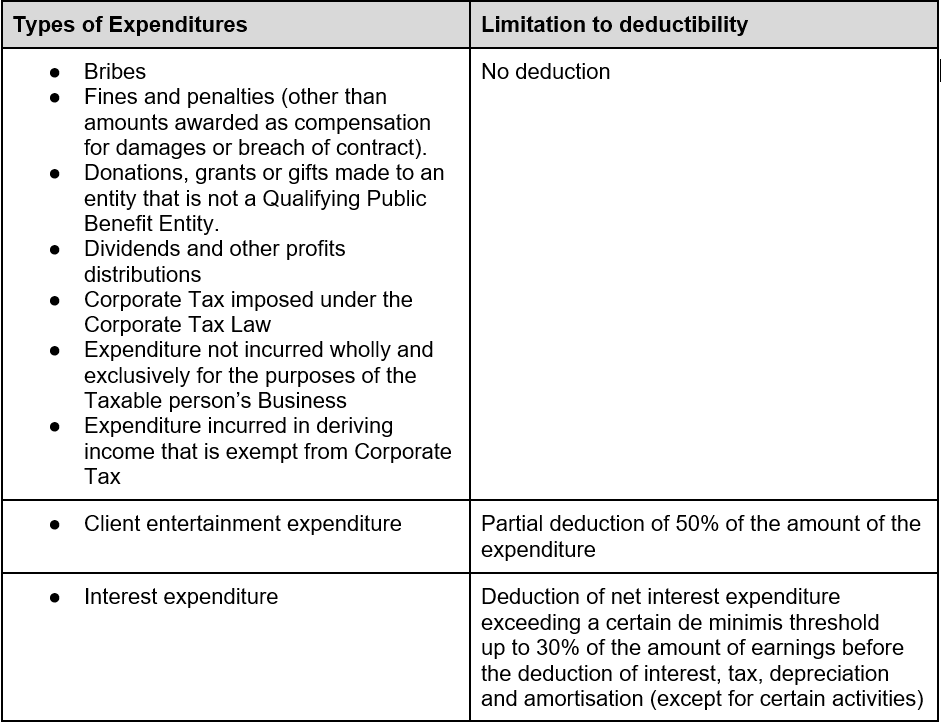

In essence, all legitimate business expenses that are incurred exclusively and entirely for the purpose of generating Taxable Income are generally eligible for deduction. However, the timing of these deductions may vary depending on the nature of the expenses and the accounting methodology employed. When it comes to capital assets, the expenditure is typically recognized through depreciation or amortization deductions spread over the economic lifespan of the asset or its associated benefits.

Expenses that serve a dual purpose, such as those incurred for both personal and business reasons, require careful apportionment. Only the relevant portion of such expenses, which can be clearly attributed to the business aspect, is treated as deductible when incurred exclusively for the taxable person’s business purposes.

It’s important to note that while certain expenses are deductible according to standard accounting principles, they may not be fully deductible for Corporate Tax purposes. These expenses need to be added back to the Accounting Income in order to determine the Taxable Income. Here are some examples of expenditure that may or may not be deductible, either partially or entirely:

Corporate Tax rate

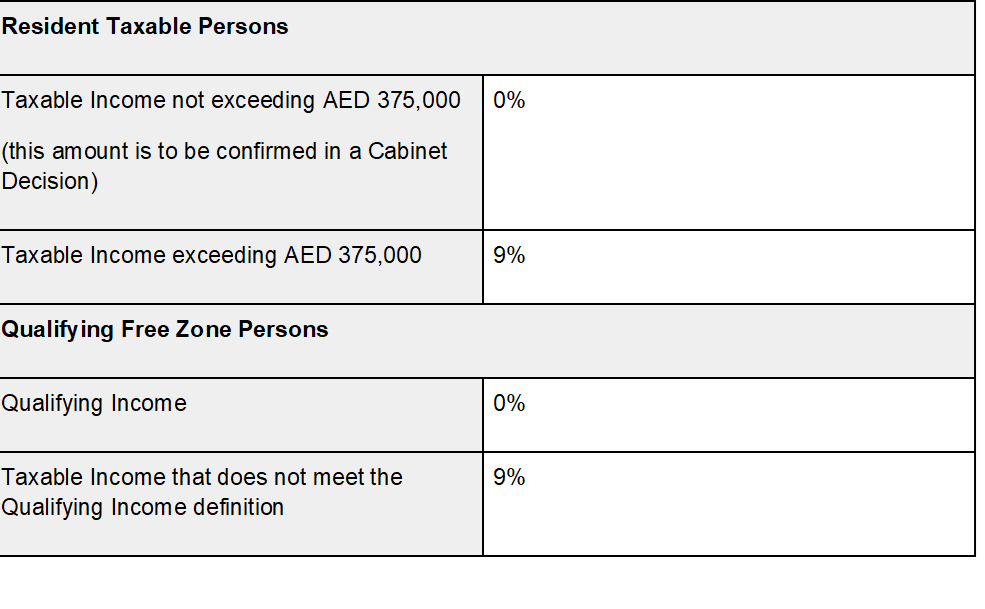

Corporate Tax will be imposed at a primary rate of 9% on Taxable Income that surpasses the AED 375,000 threshold. Taxable Income falling below this specified limit will be subject to a Corporate Tax rate of 0%. Corporate Tax will be assessed on Taxable Income in the following manner:

Withholding Tax rate

A 0% withholding tax rate may be applicable to specific categories of income sourced from the UAE when paid to non-resident entities. Due to this 0% rate, in practical terms, no withholding tax would be payable, and there would be no corresponding obligations for UAE businesses or foreign recipients of income from UAE sources in terms of withholding tax registration and filing requirements.

It’s important to note that withholding tax does not come into play for transactions conducted between UAE resident entities.

When can a Free Zone Person be a Qualifying Free Zone Person

A Free Zone Person meeting the criteria as a Qualifying Free Zone Person is eligible for a preferential Corporate Tax rate of 0%, but this rate applies exclusively to their “Qualifying Income.” To qualify as a Qualifying Free Zone Person, the following conditions must be met:

- Maintain sufficient presence and operations within the UAE.

- Generate income that qualifies as “Qualifying Income.”

- Not have opted to be subject to Corporate Tax at the standard rates.

- Adhere to the transfer pricing requirements specified in the Corporate Tax Law.

The Minister may introduce additional prerequisites that a Qualifying Free Zone Person must satisfy.

If a Qualifying Free Zone Person fails to meet any of these conditions or chooses to be subjected to the regular Corporate Tax regime, they will become liable for the standard Corporate Tax rates, starting from the Tax Period in which they no longer fulfill the conditions.

Tax Groups

Under specific conditions, two or more Taxable Persons have the option to apply for the formation of a “Tax Group,” whereby they will be regarded as a unified entity for Corporate Tax purposes. To establish a Tax Group, both the parent company and its subsidiaries must meet certain criteria, including:

- Being resident juridical persons.

- Sharing the same Financial Year.

- Utilizing the same accounting standards in their financial statements.

Moreover, for a Tax Group to be formed, the parent company must fulfill the following requirements:

- Possess at least a 95% ownership stake in the subsidiary.

- Hold no less than 95% of the voting rights in the subsidiary.

- Be entitled to at least 95% of the subsidiary’s profits and net assets.

These ownership, voting rights, and entitlements can be held either directly or indirectly through subsidiaries. However, it’s important to note that a Tax Group cannot include an Exempt Person or a Qualifying Free Zone Person.

To ascertain the Taxable Income of a Tax Group, the parent company must compile consolidated financial accounts that encompass each subsidiary belonging to the Tax Group for the relevant Tax Period. Transactions between the parent company and each member of the group, as well as transactions among the group members themselves, will be eliminated for the purpose of determining the Taxable Income of the Tax Group.

Registering, filing and paying Corporate Tax

All Taxable Persons, including Free Zone Persons, are mandated to register for Corporate Tax and obtain a Corporate Tax Registration Number. Furthermore, the Federal Tax Authority may request specific Exempt Persons to also undergo registration for Corporate Tax.

Taxable Persons are obligated to submit a Corporate Tax return for each Tax Period within 9 months from the conclusion of the relevant period. This same deadline typically applies to the payment of any Corporate Tax liabilities pertaining to the Tax Period for which a return is filed.

Outlined below are examples illustrating the registration, filing, and payment deadlines for Taxable Persons with a Tax Period (Financial Year) ending either on 31 May or 31 December (respectively):